Invest in highly curated startups

Our focus is on ground-breaking startups that offer capital efficient business models, clear path to revenue and to profitability.

Track Record

At 369 Growth Partners, we pride ourselves on delivering outstanding results for both our startups and investors. With a robust portfolio of high-growth startup investments, we have consistently demonstrated our ability to identify and support innovative companies.

Our performance speaks for itself, with several successful exits and an impressive internal rate of return (IRR). Our total portfolio market value has surpassed hundreds of billions of dollars, further reflecting the impact and success of our carefully curated investment strategy.

Startups Invested

M&As

IPOs

Deals Reviewed vs. Invested

AUM

Combined Market Cap

Syndicate Funding

Venture Capital

Advisory

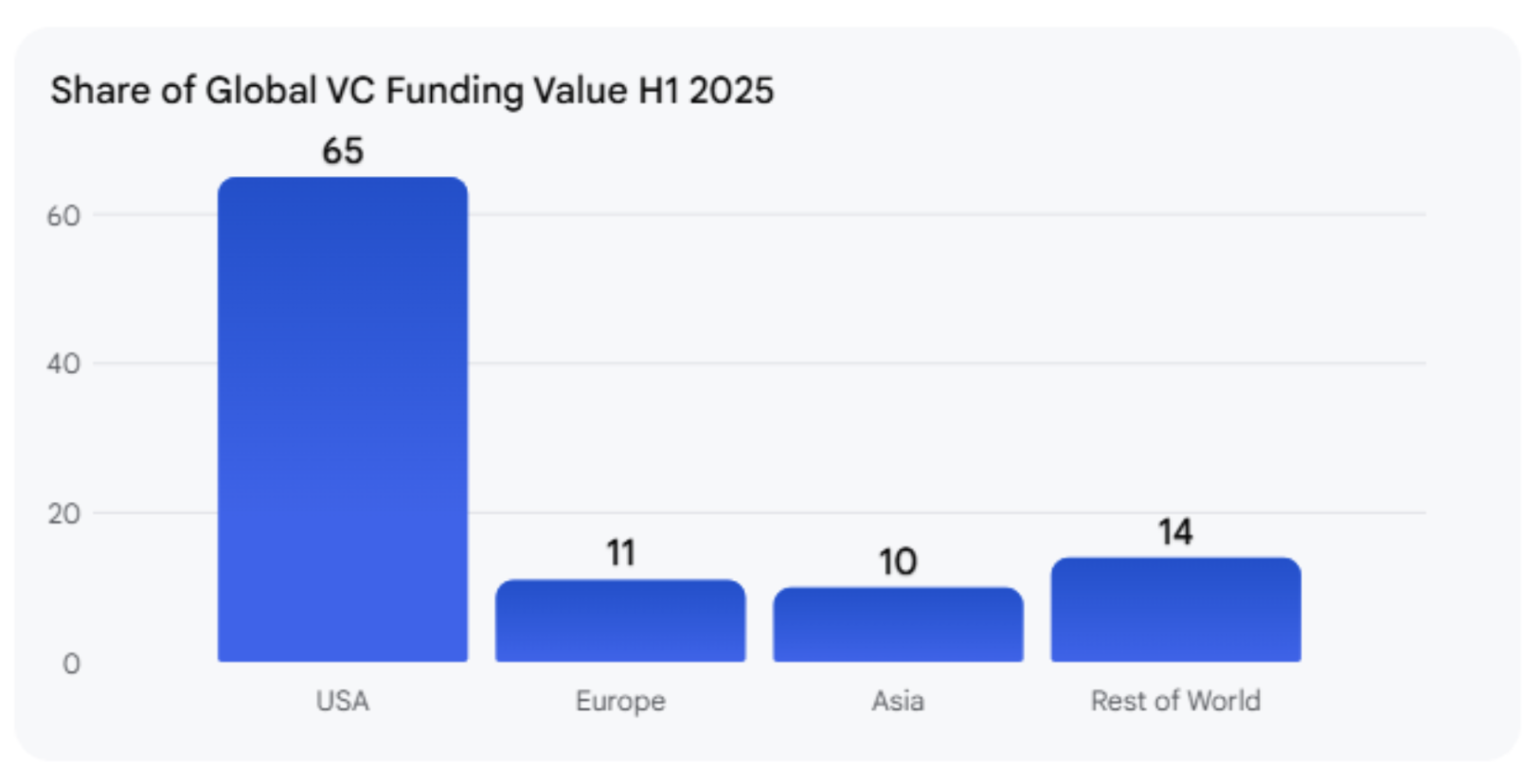

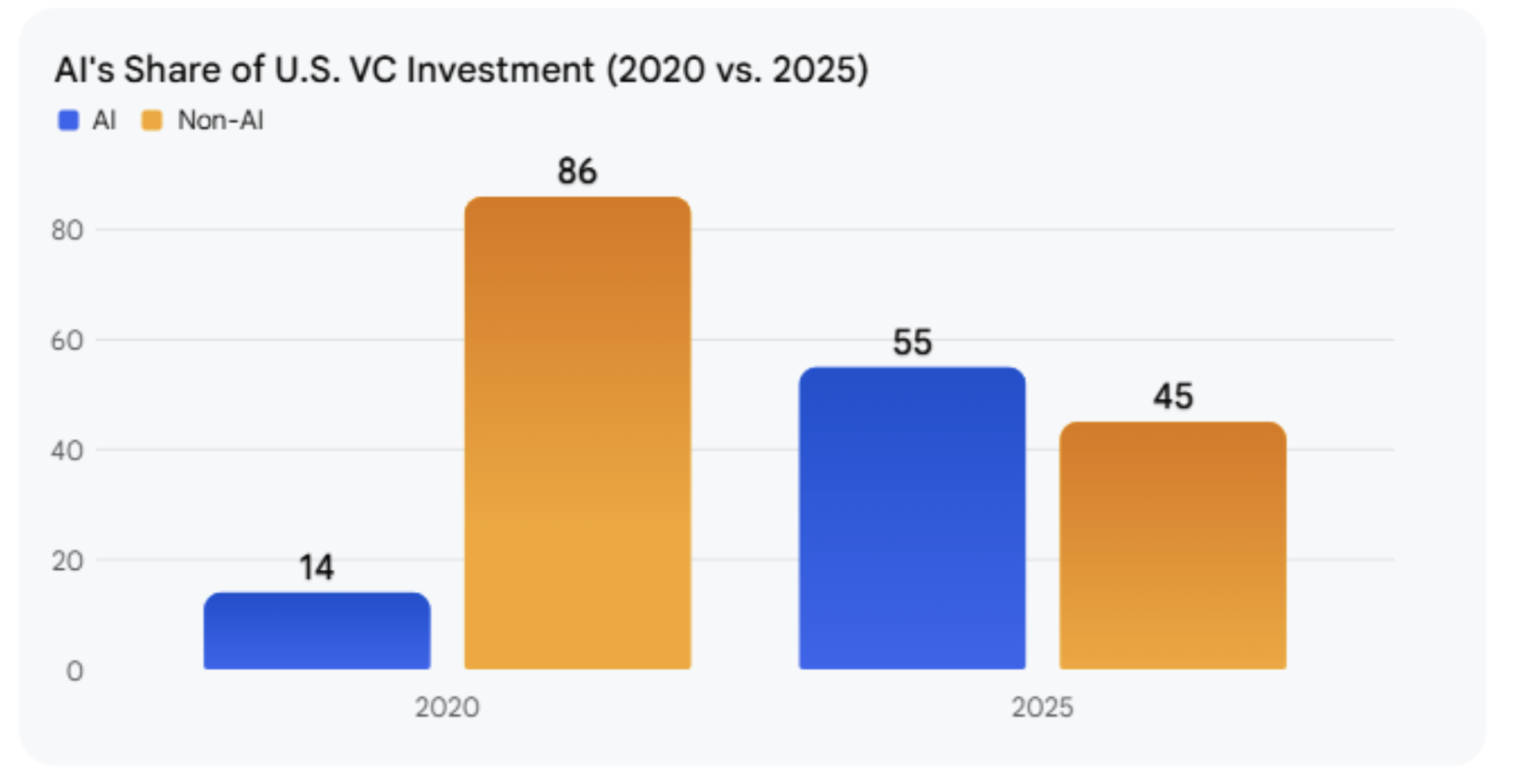

VC Funding Landscape

The 2025 VC funding landscape is defined by a significant global surge in invested capital, primarily driven by massive AI “mega-deals” such as OpenAI's $40B round. The US continues its dominance, capturing roughly 65% of the global funding share and hosting nearly all of the largest deals. The EU maintains relative stability at approximately $12-13B per quarter but faces its lowest annual fundraising total in a decade due to fewer fund closures. Meanwhile, Asia's market shows divergent trends, with a sequential rise in Q3 2025 funding that nonetheless remains below prior-year peaks. The market is increasingly concentrated, with over half of all global VC dollars funneled into AI-related infrastructure and applications. The landscape presents a clear bifurcation: a massive influx of capital into highly favored sectors contrasts with challenges in others. Key sectors attracting investment include AI, Deep Tech, Healthcare, Defense Technology, and a $1.31T U.S. Fintech Market. While total dollar amounts are high, the number of deals has actually declined across stages, indicating intense investor selectivity and a “higher bar” for new ventures. This caution is most evident in early-stage financing, where deal volume is down and capital is increasingly focused on later-stage companies with proven potential. Consequently, the difficult IPO market has pushed founders and investors toward secondary market sales and M&A activity as primary exit strategies.

The chart below illustrates the robust growth in U.S. defense technology VC investment, which has remained resilient and grown significantly since 2015. It is on track to potentially exceed its $55 billion peak in 2021 with a projected $76 billion for the full year 2025.

Check out our portfolio of strategic investments.

Founders and Principles of 369 Growth Partners have invested in over +300 Startups with combined market valuation of ~$2.5T

Founders and Principles of 369 Growth Partners have invested in over +300 Startups with combined market valuation of ~$2.5T

We invest in emerging companies in the following key areas of interest and/or industries

Artificial Intelligence

Deep Tech

Healthcare

Space & Defense Tech

Fintech